29+ Mortgage principal calculator

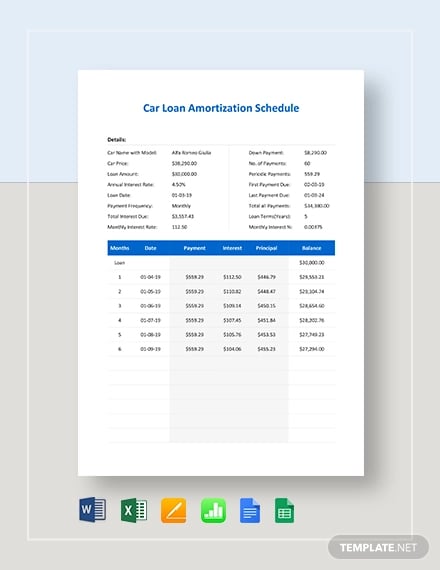

The calculator also shows how much money and how many years you can save by making prepayments. To use our amortization schedule calculator you will need a few pieces of information including the principal balance for your mortgage your annual interest rate the term of the mortgage and your state of residency.

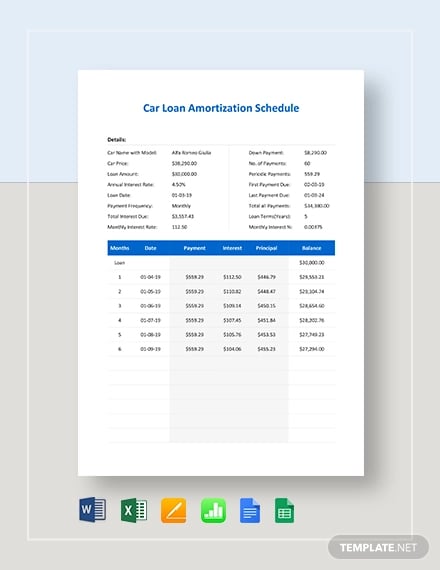

Amortization Schedule Template 13 Free Word Excel Pdf Format Download Free Premium Templates

The extra payments.

. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. Mortgage Calculator excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments. NACAs Housing Counselors work with members to prepare them for homeownership including determining an affordable mortgage payment consisting of the principal interest taxes insurance and HOA.

While the maximum affordable mortgage. In some cases the second mortgage is an adjustable rate. They can also be rolled into the loans principal.

After years of paying the mortgage your principal owed may be greater than the amount you initially borrowed. Well Balanced up to LVR 80. You can choose to make an.

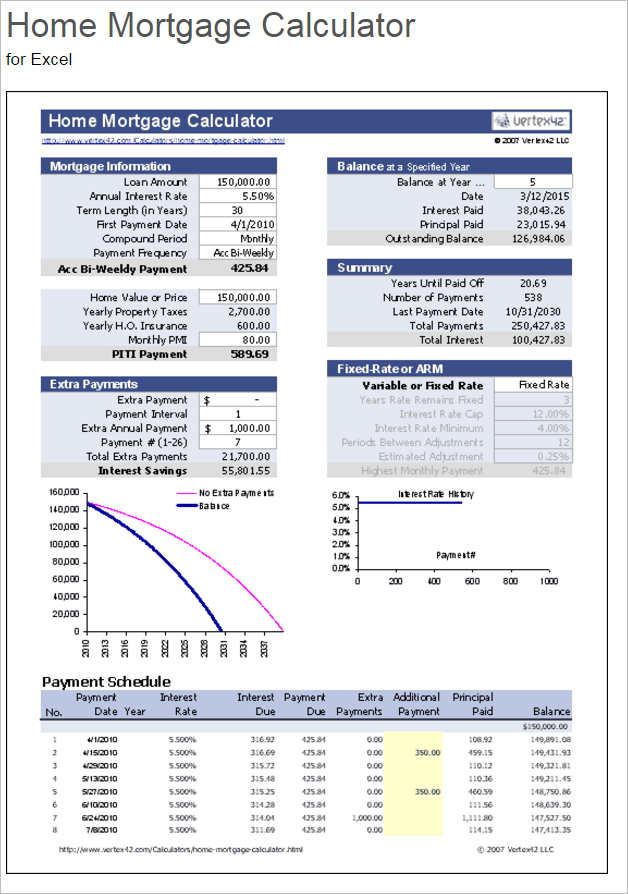

Our mortgage calculator includes principal and interest based on your input and estimates property taxes and insurance which you can update for a more accurate monthly mortgage payment estimate. Use our free Principal and Interest Calculator to see your mortgage principal vs interest split. Across the United States 88 of home buyers finance their purchases with a mortgage.

Use this free calculator to see how even small extra payments will save you years of payments and thousands of Dollars of additional interest cost. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. Of time a variable rate mortgage the interest rate is dictated by the prime rate with any changes reflecting on the principal not the fixed payments and an adjustable rate.

However an increasingly common option is the 15 year balloon. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan.

As you pay off your mortgage the principal that goes towards your mortgage principal will go up while the interest portion will go down. Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3. While youll find PITI on virtually all mortgage payment breakdowns you may also have other expenses like.

The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term. The loan is secured on the borrowers property through a process. This calculator will help you to determine the principal and interest breakdown on any given payment number.

This will be the only land payment calculator that you will ever need whether you want to calculate payments for residential or commercial lands. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Your mortgage principal balance is the amount that you still owe and will need to pay back.

Additional payments of 50 to 100 a month have the most impact during the early years of a loan. Points can be paid upfront by the home buyer andor seller. Whatever extra you pay today is extinguished debt not accruing any further interest forever.

M Mortgage P Principal amount I Monthly interest rate yearly rate divided by 12 months N Number of monthly payments for the duration of the loan 15 years x 12 months 180 payments We recommend using a mortgage calculator to easily calculate your mortgage payment. Over time the balance of the loan falls as the. The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage.

Making extra payments early in the loan saves you much more money over the life of the loan as the extinguised principal is no longer accruing interest for the remainder of the loan. Theres a way to reduce your term without choosing a 15-year fixed-rate loan or refinancing. This can be done by making extra mortgage payments toward your principal.

Our Canadian Mortgage Calculator allows you to calculate your monthly mortgage payments and cash needed for the purchase of real estate using current lender rates. As you make mortgage payments your principal balance will decrease. For a 240000 loan 1 point would be 2400.

You can check your budget using a mortgage affordability calculator. The earlier you. Second mortgages come in two main forms home equity loans and home equity lines of credit.

Second mortgage types Lump sum. This calculator can help you. Free online mortgage amortization calculator including amortization schedules and the related curves.

If you have a 30-year fixed-rate mortgage of 150000 and your FICO credit score is within the 660 to 679 range the myFICO Loan Savings Calculator estimates you could pay 3375 APR based on interest rates as of Oct. The amount of interest that you pay will depend on your principal balance. To help determine whether or not you qualify for a home mortgage based on income and expenses visit the Mortgage Qualifier Tool.

If you make multiple types of irregular or one off payments you can put just about any scenario into our additional mortgage payment calculator and see what your current or. Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. Payment Beginning Balance Principal Interest Ending Balance.

The Mortgage Calculator is crucial in determining the mortgage amount based on an affordable monthly mortgage payment. This calculator determines your mortgage payment and provides you with a mortgage payment schedule. You can also enter additional payments to see how this affects your overall mortgage length.

This is the highest that the adjustable interest rate is permitted to reach. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. A piggyback can be a first mortgage for 80 of the homes value and a second mortgage for 5 to 20 of value depending upon how much the borrower puts down as a payment.

Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000. Interest is the fee for borrowing the money usually a percentage of the outstanding loan balance. Use the interest rates calculator to forecast repayments.

This means that when you get a mortgage and borrow 400000 your mortgage principal will be 400000. Additional mortgage payments have the biggest impact during the first years of the loan. You may think 50 or 100 a month is a small sum but no amount is too small.

The principal is the portion of the payment devoted to paying down the loan balance. Typically 1 point is equivalent to 1 of the loans principal. On a fixed-rate mortgage the upfront points payment guarantees the lower rate of interest for the life of the loan.

This is because the principal or outstanding balance is larger. If you cannot afford a shorter term dont worry.

Fha Mortgage Calculator With Monthly Payment Fha Mortgage Mortgage Loan Calculator Mortgage Amortization Calculator

Early Mortgage Payoff Calculator Mls Mortgage Amortization Schedule Mortgage Refinance Calculator Mortgage Payoff

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Loan Calculator

Loan Amortization With Microsoft Excel Tvmcalcs Com Amortization Schedule Schedule Templates Schedule Template

Printable Mortgage Calculator In Microsoft Excel Mortgage Loan Calculator Mortgage Amortization Calculator Refinancing Mortgage

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Home Equity Loan Mortgage Amortization Calculator

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortizatio In 2022 Mortgage Amortization Calculator Amortization Schedule Amortization Chart

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

Loan Amortization Schedule In Excel Amortization Schedule Interest Calculator Excel Tutorials

9 Excel Mortgage Loan Calculator Templates Free Pdf Formats

Download Our Free Mortgage Payment Calculator With Extra Principal Payment Excel Template Input Only Fe Mortgage Payoff Free Mortgage Calculator Loan Payoff

Monthly Amortization Schedule Excel Download This Mortgage Amortization Calculator Template A Amortization Schedule Mortgage Amortization Calculator Mortgage

Amp Pinterest In Action In 2022 Amortization Chart Amortization Schedule Mortgage Amortization Calculator

Loan Amortization With Extra Principal Payments Using Microsoft Excel Amortization Schedule Mortgage Amortization Calculator Money Management Advice

Home Loan Comparison Spreadsheet Amortization Schedule Mortgage Amortization Calculator Loan Calculator

9 Excel Mortgage Loan Calculator Templates Free Pdf Formats

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

Komentar

Posting Komentar